Turkey’s government is making cheap credit a key part of its campaign, pushing banks to take on greater risks in an economy that’s already teetering on the brink of recession, Bloomberg reported on Wednesday.

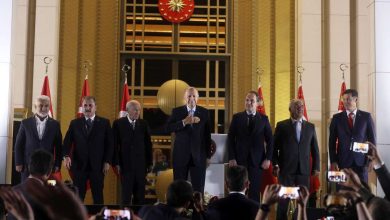

President Recep Tayyip Erdoğan’s administration is urging state-owned lenders to extend cheap loans to industries spanning agriculture to soccer clubs and help consumers pay off their credit cards or get below-market interest rates on mortgages. The government hopes this will force other banks to come to the party after they pulled back on extending credit to deal with billions of dollars in debt-restructuring requests and a growing pile of bad loans.

“It’s very possible the government is understating risks,” said Julian Rimmer, a trader at Investec Plc in London. “Many of the measures introduced by the government to address problem loans and delinquent credit cards and so on are cosmetic, and merely sweeping things under the carpet. It’s not a magic carpet though and someone has to take the loss on a default at some point.”

That’s bad news for Erdoğan ahead of municipal elections next month. He’s presided over years of supercharged credit growth that ended in a currency crash last year. While the lira has recouped a third of its value since August, it’s still one of world’s worst performing emerging market currencies. Inflation is at a 15-year high and more locals are making deposits in gold and foreign currency.

The government is avoiding taking substantial measures, such as establishing a bad bank to free up lenders’ balance sheets, because “it’s both underestimating the scale of problem and sees it as politically costly,” said Bloomberg Intelligence analyst Tomasz Noetzel. “The government seems to be using state-run lenders to fix some problems but offering cheaper loans isn’t the way for a banking-system recovery.”

The “bad bank” theme could resurface this year with soured loans set to soar, he said, adding that some of the $30 billion of debt currently classified as being under close watch, could be booked as non-performing loans.

The banking regulator is confident lenders have enough ammunition to fight challenges even after it almost doubled its non-performing loan (NPL) ratio forecast for 2019 to 6 percent and as the lira’s depreciation pushes up funding costs, hits profits and weakens capital buffers. Average capital adequacy ratios may fall to 15.5 percent from 18 percent, the regulator said, pointing out that this is significantly above the 8 percent Basel III requirement and 12 percent national minimum.

Still, some analysts aren’t as optimistic. Arvid Tuerkner, EBRD’s managing director for Turkey, expects the ratio of bad loans to be more than 6 percent this year, “not dramatically higher, but around higher single digits.” VTB Capital expects the ratio to reach 7 percent by the end of the year.

The government has already recapitalized three of its banks by selling bonds to its unemployment fund. Two private banks, Akbank TAS, and Italy’s UniCredit SpA’s Turkey unit Yapı Kredi Bankası, also boosted their capital.

Banks are being held back by record high loan-to-deposit ratios after a credit binge in 2017 stoked by a state-backed guarantee fund. Annual loan growth adjusted for movements in the lira against other currencies is now shrinking by about 3 percent, compared with a year ago, when it was expanding at 10 percent according to central bank data.

“The extent of problematic loans should be recognized and reported, then alternative solutions including a bad bank should be discussed,” said İnan Demir, an economist at Nomura Plc in London. “Otherwise, what is at stake is the pace of growth recovery.”

Moody’s Investors Service said in a report in November that Turkey’s economy would probably shrink 2 percent this year after expanding an estimated 1.5 percent growth in 2018. The International Monetary Fund said it sees “a large projected contraction in 2019 and a slower recovery in 2020” in Turkey.

Add to that gloomy outlook the uncertainty of the government’s plans to seize the main opposition party’s stake in the nation’s largest-listed lender, Türkiye İş Bankası, and its little wonder the biggest lenders are trading below their book values. Erdoğan has made repeated calls to seize the 28 percent holding, accusing the opposition of “exploiting” the memory of the founder of modern Turkey, who bequeathed İşbank shares to the party he created in his will.

“Avoid banks until elections are over and until we have a clear picture of the damage the recession has caused on the banks’ balance sheets,” Rimmer of Investec said. “And also until the İşbank fiasco is clarified.”

Source: Turkish Minute